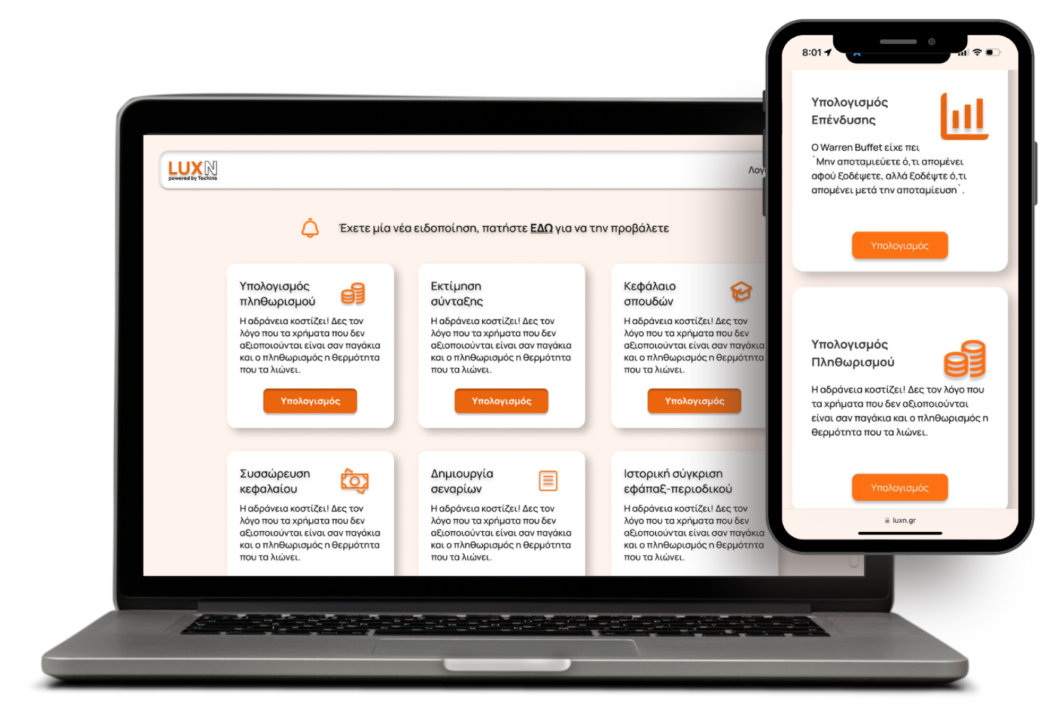

Lux is the indispensable partner for insurance professionals, empowering them to effortlessly, swiftly, and interactively present a spectrum of products including unit-linked policies, life insurance plans, and comprehensive hospitalization programs.

Work with us

Inflation Calculation

Analyze how inflation impacts the value of investments or savings over time and adjust financial strategies accordingly.

Investment Calculation

Evaluate potential returns or growth on investments through customizable parameters and projections.

Capital Accumulation

Tools or strategies to help systematically build wealth over a defined time frame.

Pension Estimation

Calculate expected pension income based on contributions, expected returns, and withdrawal timelines.

Education Fund Calculation

Plan and save for educational expenses by estimating future costs and savings needs..

Purchase History

Maintain and analyze records of past financial transactions to support better decision-making.

Historical Simulation of Lump-Sum Payments

Analyze the historical outcomes of lump-sum investments versus periodic contributions.

Additional Pension Calculation

Assess options for boosting retirement income through supplementary pension schemes.

Postponement Cost Presentation

Illustrate the financial cost of delaying investments or contributions with visual data.

Useful Resources

Provide educational materials, tools, and references to enhance financial literacy.

Detailed Product Presentation

In-depth explanation of financial products, tailored to specific client needs.

Market Crisis Analysis

Explore and interpret the effects of financial crises on investments and propose risk mitigation strategies.

Historical Comparison of Periodic and Lump-Sum Returns

Compare the results of investing periodically versus one-time lump sums across different market periods.

Scenarios Comparing Periodic and Lump-Sum Returns

Create projections for potential outcomes of various investment timing strategies.

Comparison with Other Investment Vehicles

Contrast different investment options to identify the most suitable for specific goals.

Family Protection

Financial planning focused on life insurance and related measures to safeguard family well-being.

Training Videos

Educational content to explain complex financial topics or tools effectively.

Home Purchase

Tools and strategies for planning, saving, and financing a home purchase.

Comparison with Guaranteed

Evaluate investment options against guaranteed return products, focusing on risk and reward trade-offs.

Inheritance Tax Calculation

Plan inheritance to minimize tax liabilities effectively.

Combination of Life Insurance with Unit Linked

Optimize investment strategies by integrating life insurance with market-linked savings plans.

Tax Benefit Calculation

Analyze and maximize tax-saving opportunities in financial planning.

Financial Planning

Holistic strategies for managing money to achieve long-term goals.

Statistics on Education Costs

Provide data and trends on educational expenses to inform financial planning decisions.

EXCELLENTTrustindex verifies that the original source of the review is Google. Συνεργάτης που θέλεις, αν επιθυμείς να ξεχωρίζεις από τον σωρό ! 🫶🏻Posted onTrustindex verifies that the original source of the review is Google. Εξαιρετικοί επαγγελματίες!! Η εφαρμογή Lux φέρνει πολλαπλά αποτελέσματα!Posted onTrustindex verifies that the original source of the review is Google. Καινοτομία! Τέλεια εξυπηρέτηση!Posted onTrustindex verifies that the original source of the review is Google. Εξυπηρέτηση, αναλυτική ενημέρωση των προϊόντων. Κατανοητό κ έξυπνο για τις πωλήσεις μας. Ευχαριστούμε που είστε πάντα δίπλα μαςPosted onTrustindex verifies that the original source of the review is Google. Ποιότητα, γνώση και άμεση απόκριση. Ο ορισμός του επαγγελματισμού!Posted onTrustindex verifies that the original source of the review is Google. Ευγενεστατη η κ. που μίλησα. Πολυ βοηθητικό εργαλείο εργασίαςPosted onTrustindex verifies that the original source of the review is Google. Πολύ χρήσιμο εργαλείο για μια ολοκληρωμένη παρουσίαση στον πελάτη !!Posted onTrustindex verifies that the original source of the review is Google. Το Lux είναι ένα εξαιρετικό εργαλείο το οποίο βοηθάει παρα πολύ μέσα από τις εφαρμογές του, να κατανοήσει ο πελάτης τις επιλογές του ,τις εναλλακτικές του και τέλος το πιο συμφέρον πρόγραμμα επένδυσης για τον ίδιο!!!!! Το συνιστώ ανεπιφύλακτα !Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

recommendations